By Winston Minor, BPN Analyst

Over the past year, the Covid-19 pandemic fundamentally changed the restaurant industry. More than 110,000 eating and dining establishments closed down permanently or temporarily, wiping away more than 2.5 million jobs. Restaurants experienced a high volume increase in online orders, and consumers became reliant on last mile delivery. Out of necessity, restaurants leveraged technology to stay afloat. Almost a year later, the industry is still struggling to recover, and trends that emerged are likely to be a staple going forward.

Hospitality industry expert, Jimmy Frischling, experienced the struggle of closures, as well as the rapid adoption of technology in response. Jimmy’s firm, Branded Hospitality Group, has been highly active in identifying transformative opportunities in restaurant technology and helping companies onboard these services to navigate through the pandemic.*

When asked about the status of the restaurant industry, Jimmy responded:

To be nothing less than blunt, at the start of the pandemic, the restaurant industry was saturated and there were quite simply too many seats available for customers. The pandemic forced a number of weaker groups out of business as well as some great companies that were caught on the wrong side of a landlord or had understandable liquidity issues (the hospitality industry has never been one to keep big cash positions on hand). With the spike in demand for online delivery for food, alcohol and groceries, the industry will still be under tremendous pressure for new sources of competition and will need to leverage every tool available to succeed.

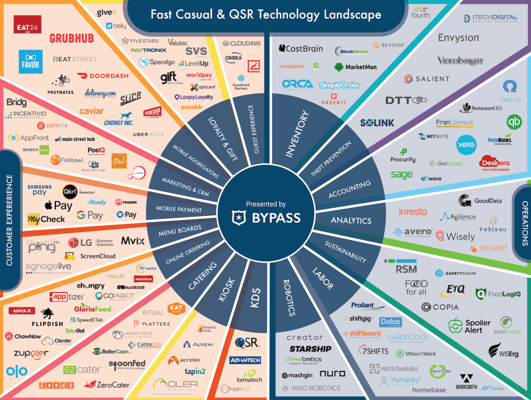

Jimmy echoes the shared sentiment in the industry that competition will remain fierce for quite some time, and longevity and success will hinge on leveraging new technologies. The restaurant technology space spans many different verticals, however we have seen the greatest impact of COVID in three main sectors: Online Ordering, Food Delivery/ Handoff, and Customer Loyalty/ Brand Marketing. Over the past 6 months, BPN has taken a deep dive into these spaces and analyzed a number of companies that are changing the restaurant tech landscape. Below we dive into a number of leading as well as up and coming companies that we believe are on their path to success based on what we have seen in the market.

Online order integration for restaurants:

Between online orders, calls, and the many third party delivery services through mobile apps, Restaurants are now responsible for managing and following through on orders from many channels. Put simply, restaurants lacked the infrastructure and technology to handle this traffic at the onset of the pandemic, evident in the picture below.

Chowly integrates all of these channels into one platform so restaurants can stay on top of increased online orders. Olo Inc., who recently filed to go public, uses their APIs to seamlessly integrate with a wide range of solutions and unify technologies across the restaurant ecosystem.

Food delivery/Pickup hand-off to consumers:

Covid has driven customers to desire contactless exchanges for acquiring their food. There are a few companies that have really benefited from this customer trend. Ritual, an online ordering platform, allows you to pick up your food in store with no contact with the staff. The platform also integrates customer loyalty within the app. Another handoff focused startup is Minnow Technologies. Minnow capitalizes on inefficiencies in the delivery hand-off between deliverers and customers. Minnow has created a delivery drop-off pod with cubbies that keep food safe and warm. For restaurants, this improves the overall customer experience and ensures quality satisfaction. For deliverers, this removes lost time connecting with customers and ensures social distancing protocols. Consumers benefit from the heated cubbies that keep their food warm and the assurance of retrieving their order.

Customer loyalty and brand marketing:

What happens after food is delivered? How can brands ensure customer satisfaction and retention? Now more than ever, Restaurants are dependent on maintaining relationships with customers to generate repeat business. Major third party delivery platform, Grubhub, acquired LevelUp in their development shop to help drive online ordering and customer loyalty using their platform to create a personalized omnichannel experience for each brand. They have landed large enterprise customers such as Pret, Sweet Green, and Potbelly, to name a few. SpendGo, a clean and easy to use customer loyalty platform, eliminates the inefficiencies in long term retention through facilitating a superior customer loyalty platform. Through a simple interface, SpendGo maintains an ongoing relationship with customers that restaurants can’t provide themselves. In doing so, SpendGo improves customer retention through offering discounts, while simultaneously providing brand endorsements for the restaurants themselves.

While these companies seem to be carving out a path in a crowded marketplace, nothing is certain. Even with a solid product market fit and some decent traction, things can go wrong. BPN is partnering with funds in the restaurant tech space as well as many other verticals, to help hone in on key market trends and the outlook for particular investments. Understanding with confidence the odds of upside and downside for an investment, even within a booming industry like restaurant technology, which is riding the tailwinds of COVID, can be crucial to the funds return on any particular deal.

If you are interested in learning more about BPN’s analysis of this space or our platform, please contact ajay@bulletpoint.network and we’ll be happy to schedule a convenient time.

*Disclosure: BPN works closely with Jimmy and the Branded team to ensure the long term success of their investments.