Case Builder: Create, Compare, and Decide With Quantitative Investment Scenario Modeling

Empower Conviction and Confidence in Investment Decisions

Bullet Point Network’s AI-driven investment analysis platform combines four integrated tools to streamline research and decision-making. By merging agentic AI with human expertise, our platform automates critical processes. This saves valuable time and boosts conviction in every investment choice.

What Is Case Builder?

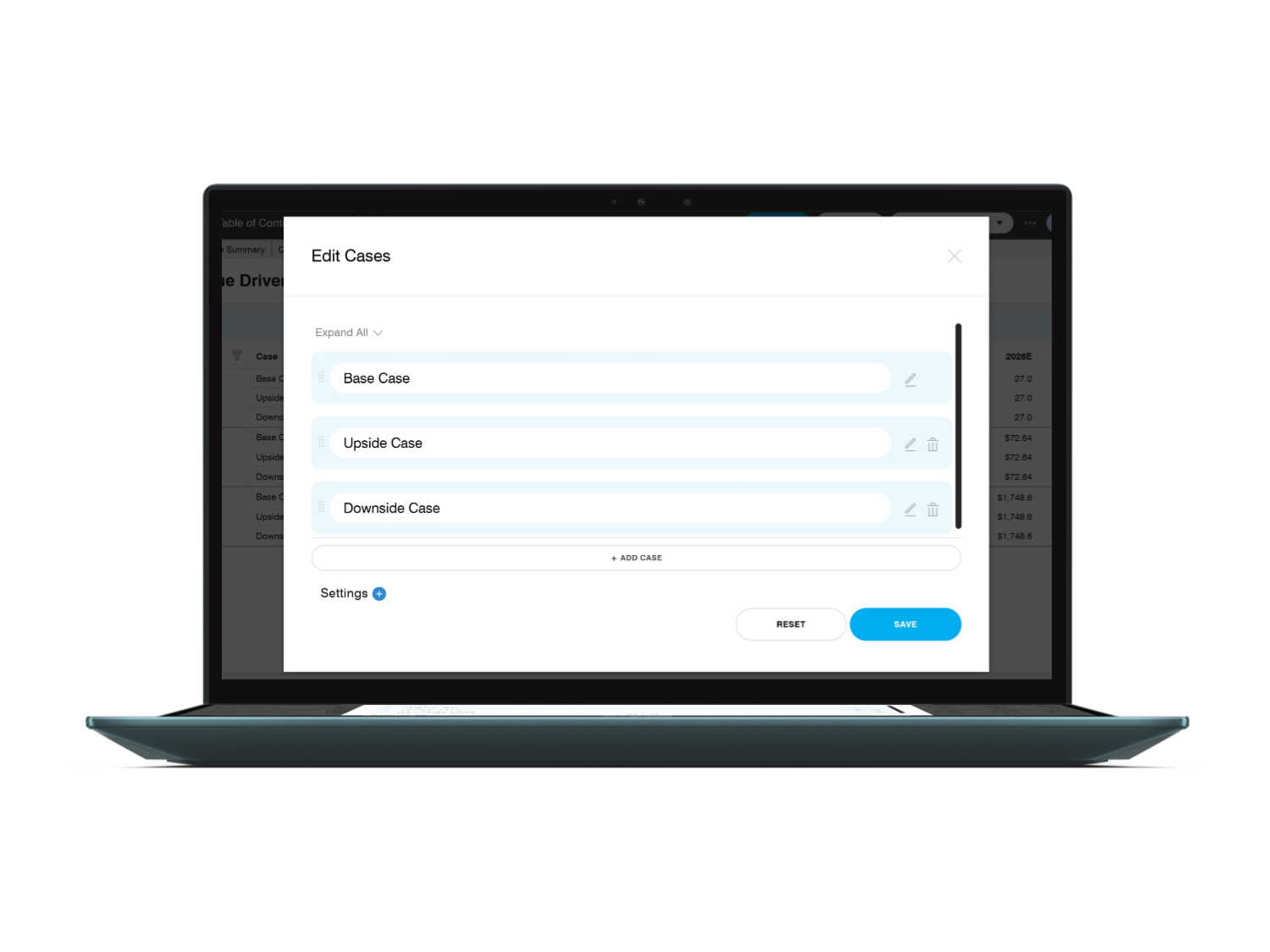

Case Builder is a robust scenario modeling tool designed to help investors assess upsides, risks, and potential outcomes. In the past, professionals accomplished this by altering complex formulas manually in existing spreadsheets or making multiple spreadsheet copies.

With our platform, this process is automated with cited sources for full transparency. Built for efficiency and clarity, Case Builder enables your team to navigate “what-if” scenarios with conviction.

How Case Builder Works

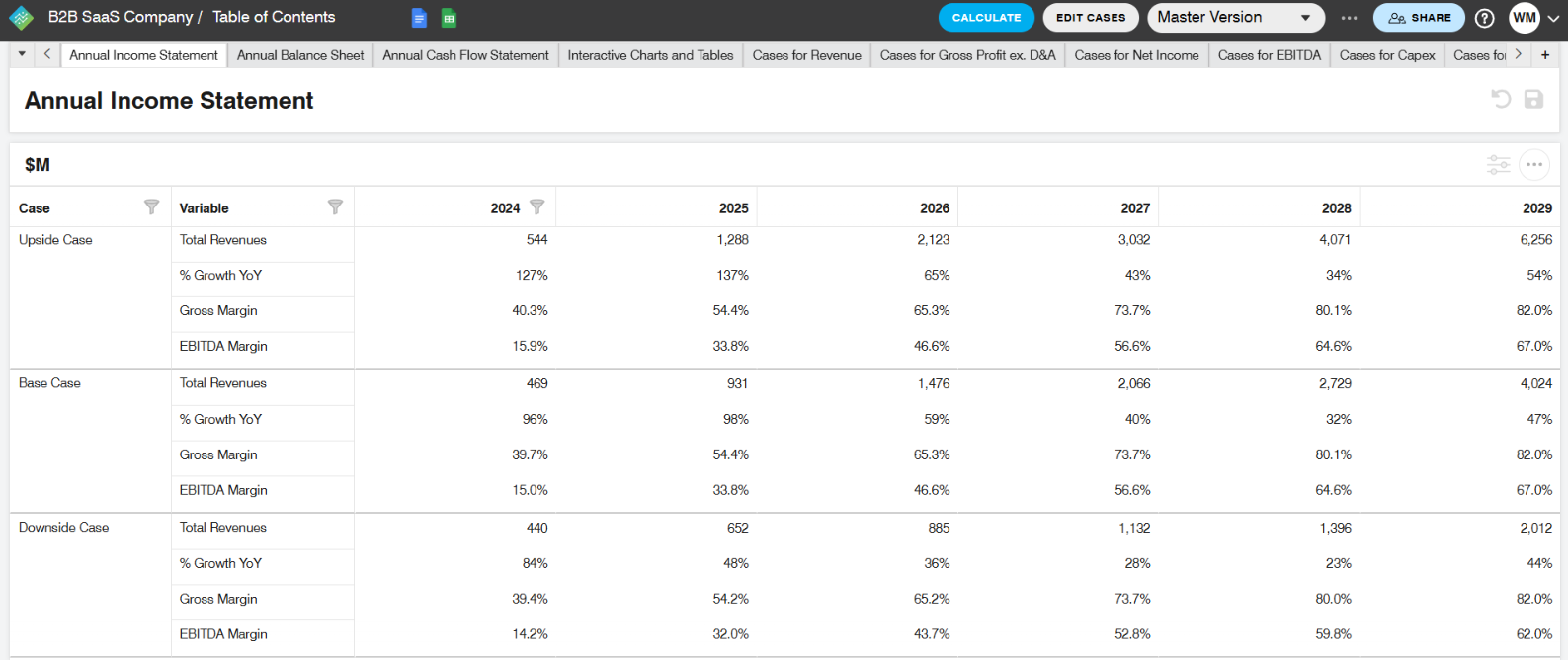

Create scenarios using varying assumptions for deals, markets, or company performance to explore potential outcomes.

Model potential outcomes instantly, all without modifying your original spreadsheets.

Compare multiple scenarios side-by-side for a clear view of the most likely possible futures.

Analyze risks and advantages to inform your next move and plan your long-term strategy.

Key Benefits

Streamlined Decision-Making Process

Move rapidly from hypothesis to insight, keeping your team focused on high-value analysis.

Improved Risk Management and Prevention

Identify and quantify risks before they impact your portfolio.

Efficient Strategic Planning

Test strategies and contingencies in a simulated environment.

Time-Saving Spreadsheet Integrity

Preserve your original models. Automated spreadsheets eliminate the risk of accidental changes or formula errors.

Key Takeaways

Case Builder allows users to easily create and manipulate scenarios, all while maintaining the integrity of existing spreadsheets. Teams can perform robust “what-if” analyses, comparing scenarios to pinpoint favorable or risky outcomes.

This AI tool supports informed decision-making and contingency planning, providing you with the confidence to act decisively.

Why Human-in-the-Loop Feedback Matters in Automated Investment Analysis

Case Builder’s AI functionality has the power to take investor workflows to the next level. However, your team’s oversight and analysis have never been more important. Human-in-the-loop feedback is essential to maximizing its value.

Human expertise ensures that the platform’s outputs are data-driven, relevant, and meet rigorous standards for investment decisions.

Improved Accuracy and Relevance

Human oversight helps correct errors, mitigate biases, and refine scenarios. This ensures that outputs are reliable and tailored to the unique context of each investment opportunity.

Domain Expertise Integration

Decisions often hinge on subtle market signals, emerging trends, and qualitative factors that AI alone may miss. Human input infuses domain-specific knowledge into the platform, making scenario analyses more insightful and actionable.

Risk Mitigation and Trust

With a humans-in-the-loop approach, teams can catch edge cases and validate assumptions. Experts can verify that recommendations align with the firm’s investment philosophy and risk appetite. This builds greater trust in the platform’s outputs and supports compliance.

Case Builder’s scenario modeling is powerful when paired with human judgment. With expert investors at the helm, the platform delivers more accurate, relevant, and actionable insights.

Boost Conviction With Bullet Point Network

Ready to transform your investment analysis with AI-powered insights? Book a demo with Bullet Point Network to experience Case Builder and our full suite of tools in action.