Case Builder: Infuse familiar spreadsheets with AI, and easily transform them into logical case models

Case Builder transforms any spreadsheet into a logical scenario model, attaching evidence and stress testing results.

Bullet Point Network’s AI-driven investment analysis platform combines four integrated tools to streamline research, analysis, and decision-making.

What Is Case Builder?

Case Builder starts with a familiar spreadsheet containing formulas and calculations you can trust (rather than LLM guesses). After the underlying spreadsheet is ingested into the platform, Case Builder makes it possible to stress test any assumption and cross-check any result using AI, and to easily create as many logical cases as you wish to explore.

Robust scenario modeling is quick and easy, so your team can evaluate upside cases, quantify downside risks, and better judge potential outcomes. In the past, diligent investment teams accomplished this by using complex formulas, manually adjusting existing spreadsheets, or making multiple copies in different tabs, without any research attached to assumptions.

Built for efficiency and clarity, Case Builder enables your team to build and explore “what-if” scenarios with ease and iterate to conviction before producing the slides and final memo.

How Case Builder Works

Start with a familiar spreadsheet, with trusted calculations that can be easily adapted to show KPIs, cash flows or valuation for the business at hand.

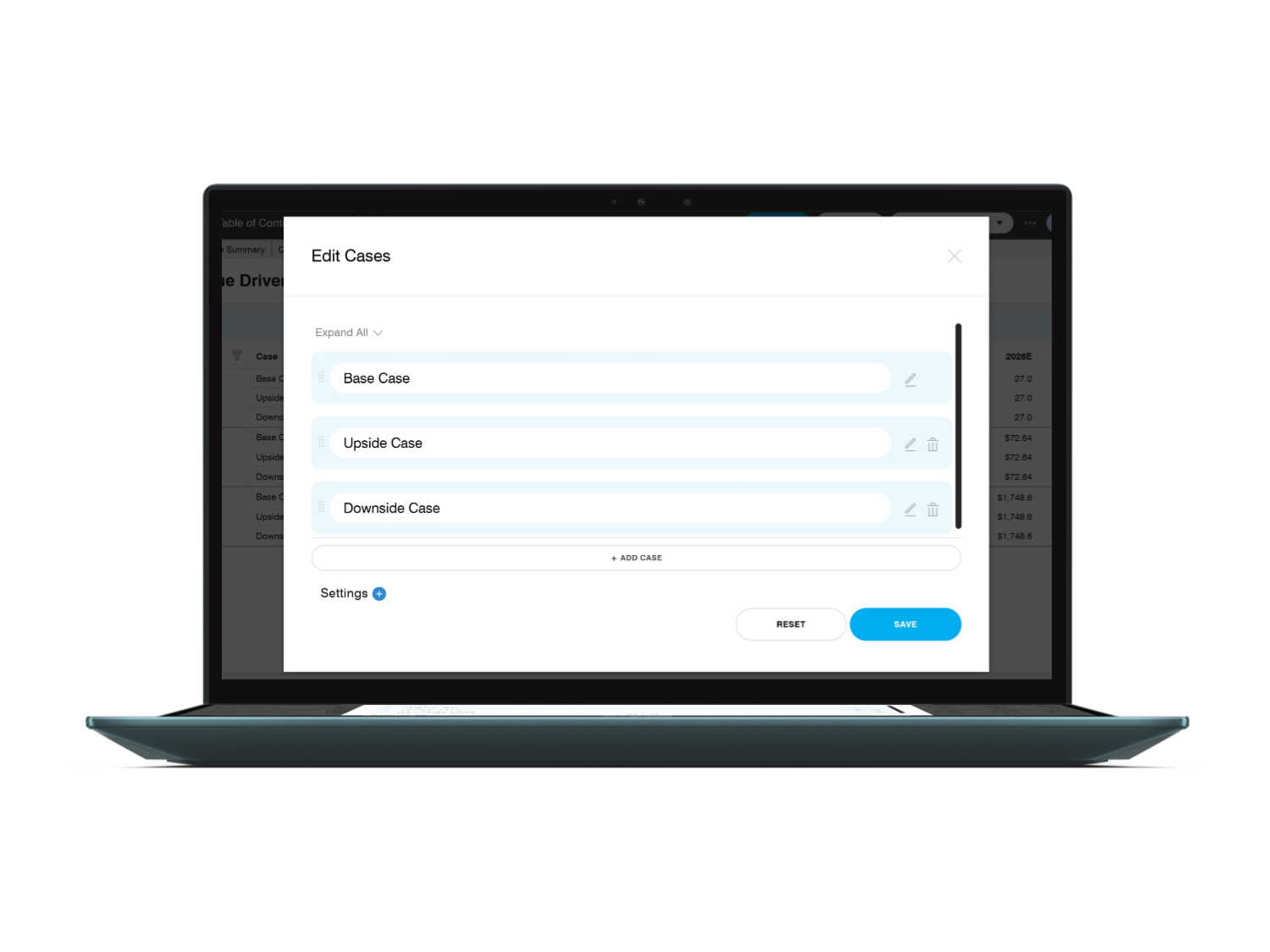

Describe the Cases you want to model, research key assumptions using AI, and create scenarios of interest to explore potential outcomes.

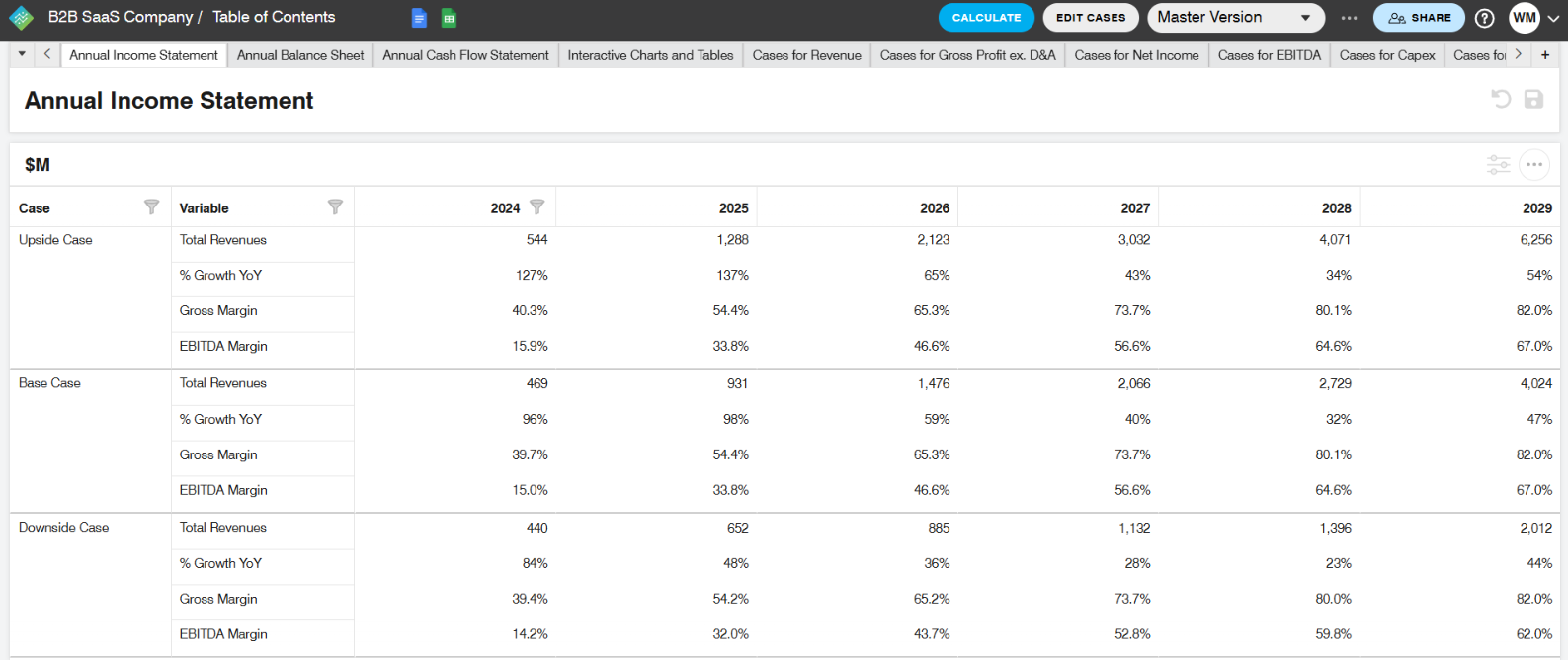

Instantly model potential outcomes across all Cases created, using the format and formulas from the underlying spreadsheet.

Compare multiple scenario assumptions and results side-by-side for a clear view of the most likely possible future outcomes, outlier potential upside and downside risks.

Use SlideDoc maker to create dynamic visualizations, view the attached research across Cases, and save versions over time.

Key Benefits

Makes Scenario Modeling Easy

AI research on any assumption or result + automated “copies” of the spreadsheet for each Case allows you team to stay focused on high-value analysis and critical thinking.

Improved Risk Management

The very process of describing Cases, populating them with assumptions and exploring the result offers actionable insight into downside risks and upside opportunities.

Efficient Iteration

Iterate on assumptions, multiple Cases and explore assumptions and results side by side. Time-stamp saved versions or allow team members to make their own personal versions to compare.

Spreadsheet Integrity

Automated Case Building eliminates the risk of accidental changes or formula errors in your original spreadsheet.

Key Takeaways

Case Builder allows users to easily create and manipulate scenarios, attach research to key assumptions, and explore results while leveraging the transparency and control of familiar spreadsheets.

Why Human-in-the-Loop Feedback Matters in Automated Investment Analysis

Case Builder’s AI functionality has the power to take investor workflows to the next level. However, your team’s insight and judgment have never been more important. We’ve built our workflows with seamless Human-in-the-loop oversight and editorial control as a first principle.

Human expertise ensures that the Platform’s outputs are relevant, nuanced, and meet rigorous standards needed for critical investment decisions. Case Builder’s scenario modeling is most powerful when paired with human judgment to ensure accurate, relevant and actionable insights.

Improved Accuracy and Relevance

Human oversight helps correct errors, mitigate biases, and refine scenarios. This ensures that outputs are reliable and tailored to the unique context of each investment opportunity.

Domain Expertise Integration

Decisions often hinge on subtle market signals, emerging trends, and qualitative factors that AI alone may miss. Human input infuses domain-specific knowledge into the platform, making scenario analyses more insightful and actionable.

Risk Mitigation and Trust

With a humans-in-the-loop approach, teams can validate AI responses against trusted sources and explore controversial topics or contradictory evidence more deeply.

Experts can verify that recommendations align with the firm’s investment thesis and risk appetite. This builds greater trust in the platform’s outputs and supports quality control, auditing and compliance.

Boost Conviction With Bullet Point Network

Ready to transform your investment analysis with AI-powered insights? Book a demo with Bullet Point Network to experience Case Builder and our full suite of tools in action!