Accelerating the Investment Analysis Lifecycle With Collaborative AI

In the past, investment analysis followed a rigid, time-intensive sequence: data and research intake, manual spreadsheet modeling, memo drafting, and stakeholder review. Each step often took days or weeks as investors juggle fragmented tools, rework assumptions, and chase down evidence. Many teams still rely on this approach.

Bullet Point Network is built to change that.

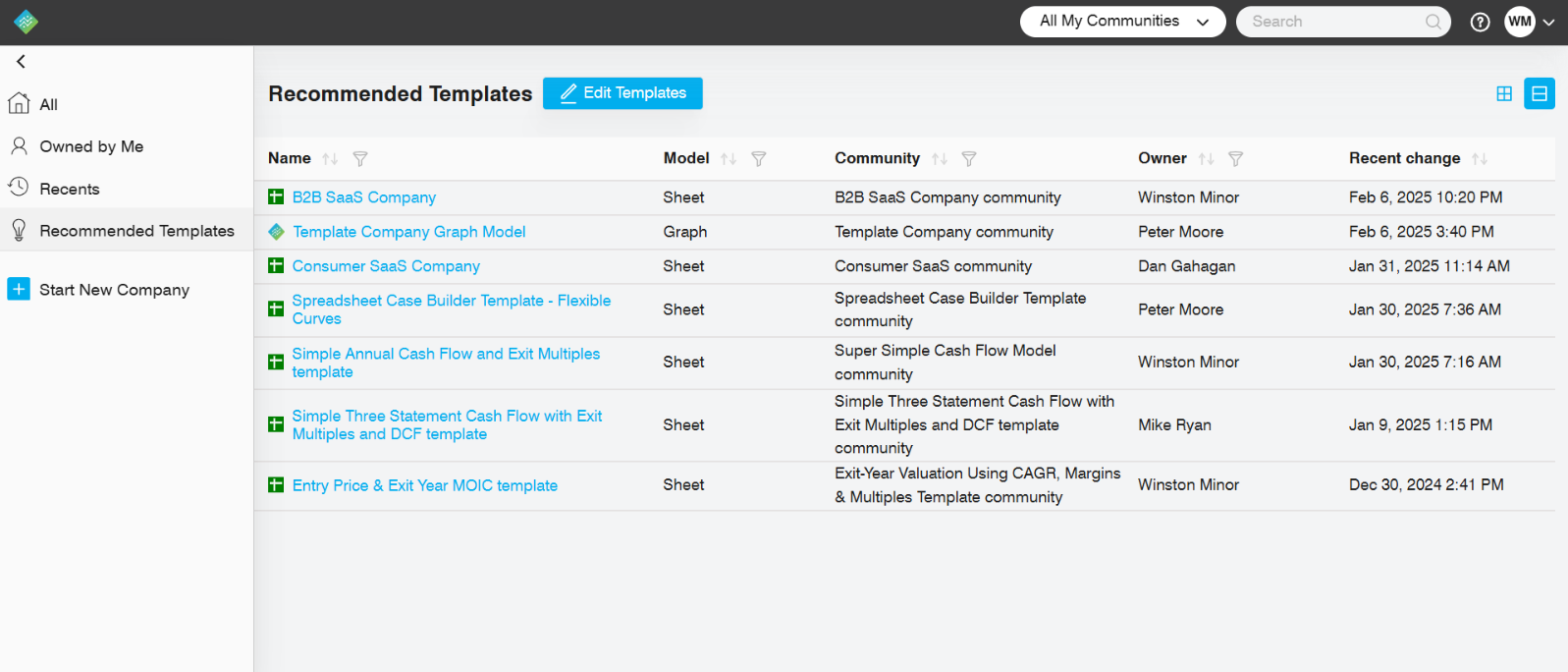

Integrating AI into existing workflows compresses the investment analysis lifecycle from weeks into days–or even hours. BPN’s platform links financial models to structured research and automated memo creation. Instead of stitching together Excel files, company data room materials, and disparate research reports and notes, investment teams work collaboratively in a single environment.

The result? Faster iteration. Stronger memos. Smarter decisions.

In this article, we’ll explore how collaborative AI redefines investment analysis. Discover how our solution aligns with the needs of today’s top-performing investment teams, driving greater returns.

The Challenge: Slow, Siloed Investment Analysis

Many teams begin the investment process by combing through a data room, and then translating their research and insight into a spreadsheet model of cash flows and exit scenarios. Investors must source, justify, and determine the assumptions driving their model from the source materials and their own expertise. Building models and ensuring key drivers are grounded in research can be a time-intensive process with the risk of human oversight and bias.

From there, memos and slide decks are manually copied, drafted, and iterated on, usually relying on a team’s ability to integrate research and analysis from disparate files. While standard practice, this approach is also prone to human error and oversight.

Disconnected workflows don’t just waste time. They erode confidence in the investment analysis process. In many cases, investors anchor their decisions before deliverables are complete because the human mind works faster than the time required to create thorough memos and decks. With BPN, blind investment decisions are a thing of the past. We help you move forward with clarity.

The Solution: Collaborative AI From Day One

Bullet Point Network integrates AI across the entire investment analysis lifecycle, starting with day-one integration of source materials, memos, and models. Four connected tools work together to eliminate friction, reduce duplication, and drive clarity.

1. Evidence Mapper

This tool uses AI to link actual evidence in your source materials to the key assumptions in your model. Teams can clearly review and debate assumptions and track rationale over time.

You choose the sources. Upload company data, third-party research, expert calls, and other critical information. The AI retrieves the answers, attaches them to the relevant cell, and cites the source. With Evidence Mapper, your assumptions are transparent and defensible.

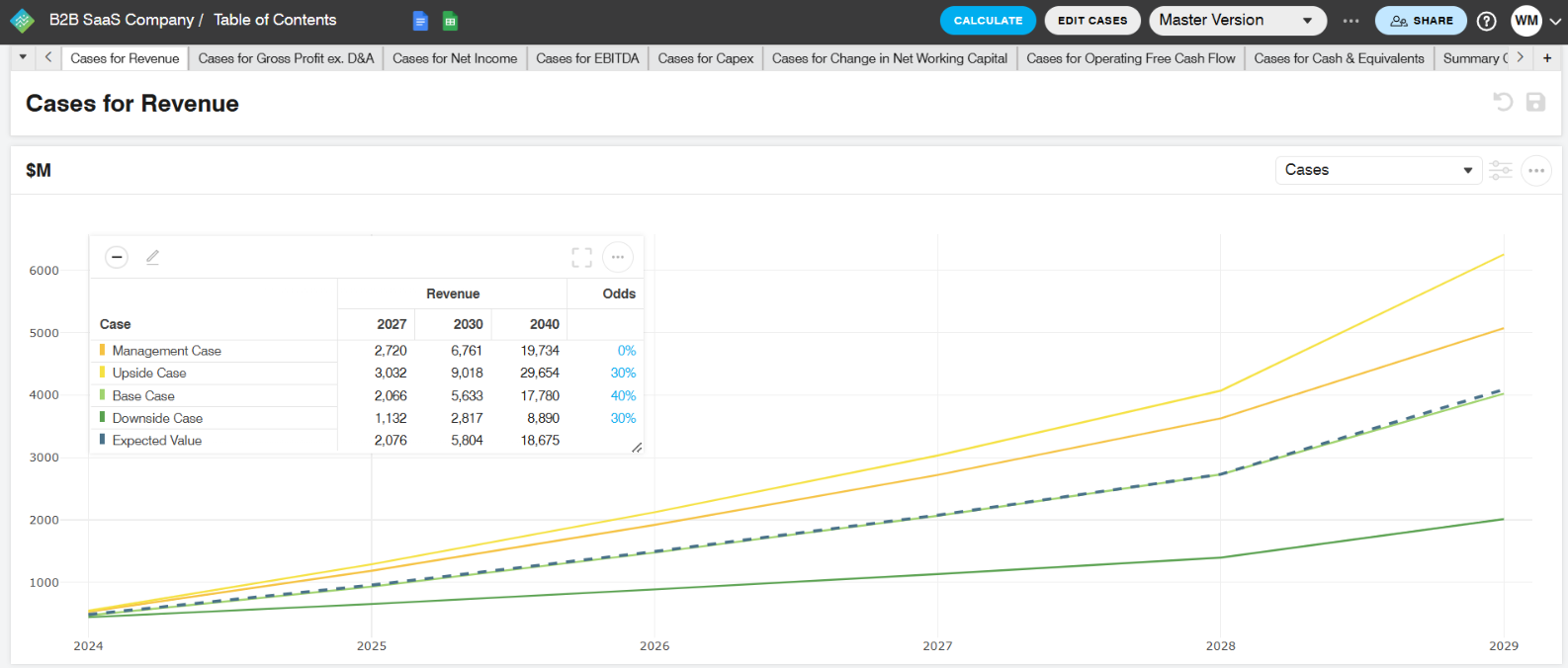

2. Case Builder

Case Builder makes scenario modeling fast and repeatable. You can test multiple cases–from downside to upside scenarios–with just a few clicks. Each case replicates the underlying spreadsheet model and calculations, ensuring accuracy and transparency.

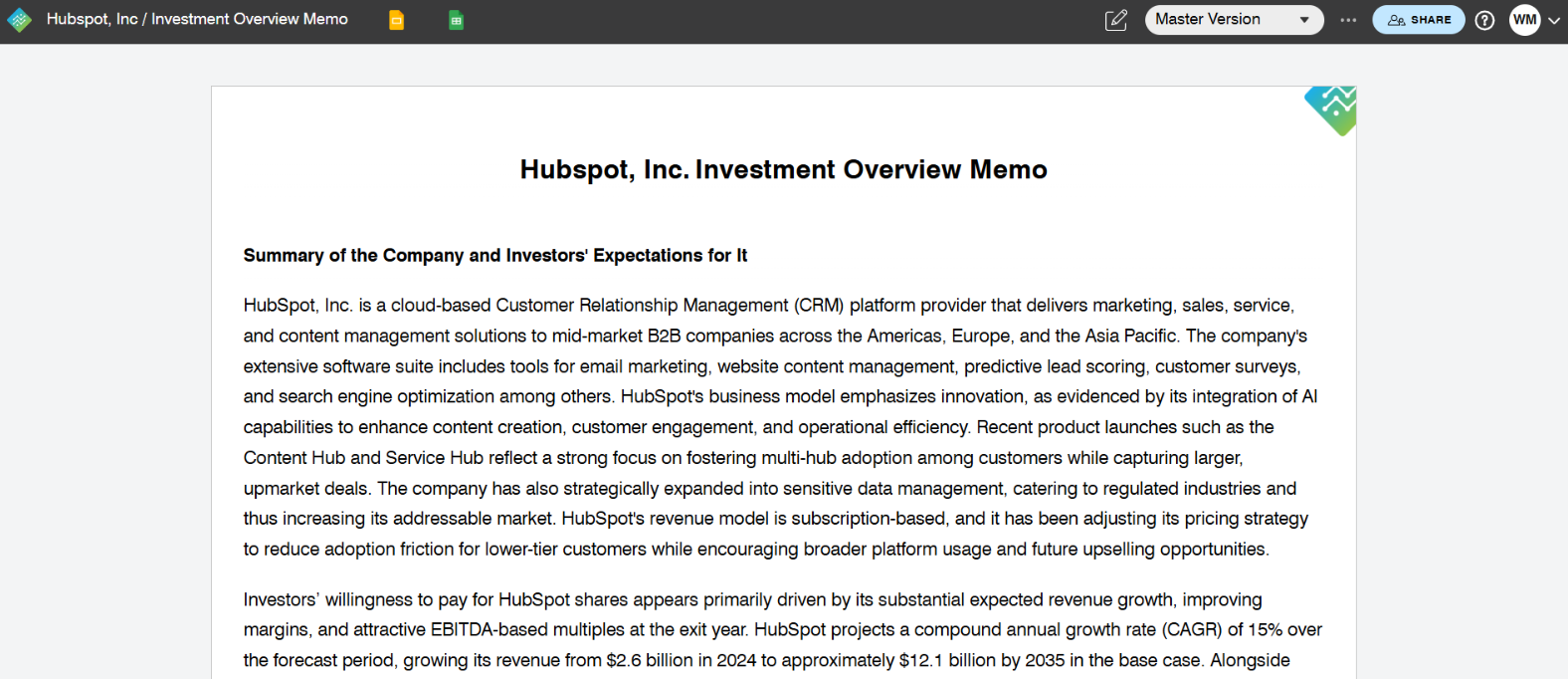

3. SlideDoc Maker

SlideDoc Maker pulls data from your spreadsheet to generate interactive charts, tables, and narrative slides. Dynamic filtering of variables, cases, and years allows you to zero in on the results that matter. Our AI agents deliver valuable insights for financial, KPI, or valuation metrics.

4. Memo Writer

Memo Writer uses AI-driven templates to turn your model, company data room, or any trusted source into a structured investment memo. Investors can use the many BPN template memos (and edit as desired) or create ones that replicate their internal memos.

It’s built from a reusable prompt template that runs automatically. The result is a consistent, editable draft that mirrors your logic and is tailored to your firm’s standards.

Instantly Draft Investment-Ready Models, Memos, and Slides

Get decision-ready materials from day one. Once your documents are uploaded, the platform generates full drafts you can refine without starting from scratch. Here’s what you can expect:

Structured investment memos, configurable to your style.

Slide decks with interactive tables and charts tied to your financial model.

Side-by-side bull, bear, and base case scenarios.

Seamlessly Integrate Spreadsheets Into the Platform

Your existing models become dynamic, no rebuild required.

Link key research to assumptions with AI-sourced answers and citations using Evidence Mapper.

Input changes automatically update memos, slides, and scenario outputs.

Stay aligned across deliverables as you iterate.

Built for Investor Oversight, Not Set-and-Forget Automation

AI supports your investment analysis, but you stay in control.

Human-in-the-loop workflows keep investors involved at every step.

Transparent outputs show how insights are generated and sourced.

Structured prompts ensure consistency while leaving room for judgment.

Quantifiable Gains for Investment Analysis Decision-Makers

Bullet Point Network dramatically reduces time-to-decision. What once took weeks now takes days or hours. Faster feedback loops mean more iterations before presenting.

The result is sharper insights, stronger memos, and faster conviction across your team. When investors see BPN’s capabilities in action, they’re consistently amazed at the speed, accuracy, and results.

“Until I saw their platform, I couldn’t understand how they were able to understand a business so quickly… With BPN, we can monitor, update, and adapt the analysis faster than anything I’ve seen.”

–Brad Feld of Foundry

From First Look to Final IC Memo, All in One Workspace

We support every stage of the lifecycle, from initial data intake and 1-pagers to your final investment committee memo. Investors upload documents, connect a spreadsheet, map evidence to assumptions, and generate memos and slides all in one intuitive platform.

Decision makers get clear, version-aligned outputs; associates and investors improve the speed and accuracy of their deliverables. Everyone stays aligned, working from a single source of truth designed for speed, traceability, and accountability.

Ready for Day-One Investment Analysis Decisions?

Book a demo to see how Bullet Point Network delivers full-stack investment analysis in hours, not weeks.