AI-Driven Investment Memos, Spreadsheet Models, and Slides Built for Modern Investment Teams

It takes a lot to be a great investor. Even if you excel at sourcing opportunities and identifying strong teams, you still need to vet each deal. AI can help drive great returns–but maybe not in the way you think it can.

When used effectively, AI improves analysis, accelerates validation, stress test results, and drives faster, more informed decisions. Tailoring AI workflows to your process and preferred style is essential. In venture capital and private equity, every decision matters. It’s critical to trace evidence to trusted sources, frame cases with numbers, and incorporate nuanced judgments.

Here’s how Bullet Point Network equips you to leverage AI to increase efficiency and build conviction. Our solution combines the best aspects of human judgment with modern research and analysis techniques.

Generate a Useful Memo, Model, and Slides in Just 24 Hours

Done right, due diligence is a time-consuming process. But what if you could develop a customized investment memo, credible financial model, and dynamic slide deck within a few hours? From there, you can build conviction with critical thinking, focused research, and debate.

The Bullet Point Network platform accomplishes just that. Our AI tools help you automate investment memo writing, model building, and more. This reduces time spent on necessary but low-value tasks and increases clarity around critical decisions.

AI Investment Capabilities for a New Era of Investors

Investment firms need to quickly decide where to spend their time. They also need to make informed final decisions about how to allocate capital. Simplistic screening methods, subjective stage gates, superficial LLM research, and fragmented workflows create bottlenecks that hinder good decision-making. Below, we break down the critical pain points.

1. Inefficient Framing of the Available Data

Sometimes, you lack key pieces of information (and/or you fill in the blanks off the top of your head). At other times, you can get trapped in information overload and find it hard to cut through the noise quickly and efficiently. Without a strong framework, you can waste a lot of time, slowing down deal evaluation and increasing the risk of human error.

2. Uncited Assumptions and Lack of Transparency

Traditional human screening and LLM models often rely on uncited data, gut instincts, or AI hallucinations. This creates blind spots in opportunity and risk assessment. Limited transparency to sources erodes trust and complicates decision-making.

3. Cognitive Biases in Decision-Making

Anchoring, confirmation bias, and herd mentality frequently skew evaluations. This is especially true when decision makers reach conclusions before the facts and figures are clearly framed. The higher the stakes and shorter the time, the more we tend to use simple heuristics instead of careful analysis.

4. The Challenge of Building Real Scenarios

Everyone tries to consider the “what-ifs,” but modeling realistic and logical cases is time-consuming. You need to make copies of your spreadsheet, update complex formulas, and gather research to support the assumptions that drive each case.

Doing anything beyond a simplified base, upside, or downside takes more time than most investors can spend. BPN’s Case Builder executes that whole process 10x faster. With us, you can spend your time thinking critically, not building cases manually.

5. Resource-Intensive Due Diligence

Teams spend dozens of hours learning about markets, identifying the competitive landscape, validating financials, understanding the executive team, and product capabilities. BPN can do this in minutes. Your time can be better spent talking to customers, suppliers, competitors, or management. You can also take the time to think critically about key assumptions, debate with your team, or source the next opportunity.

The Bullet Point Network Advantage

Bullet Point Network’s AI investment platform is built for serious investment teams who want to tailor each company’s analysis and build real conviction. We combine memo generation, scenario modeling, source traceability, and dynamic decks into a single, decision-grade platform.

Our solution enables deep research to cover blind spots and supports real spreadsheet modelling to easily explore multiple cases. It also automatically creates dynamic charts, tables, and memos that capture both the story and the numbers.

Memo Writer

Creates detailed investment memos in minutes. Use BPN templates for company overviews, initial screenings, comparables analysis, and final decisions. You can also mimic your favorite memo formats and customize the sections you need.

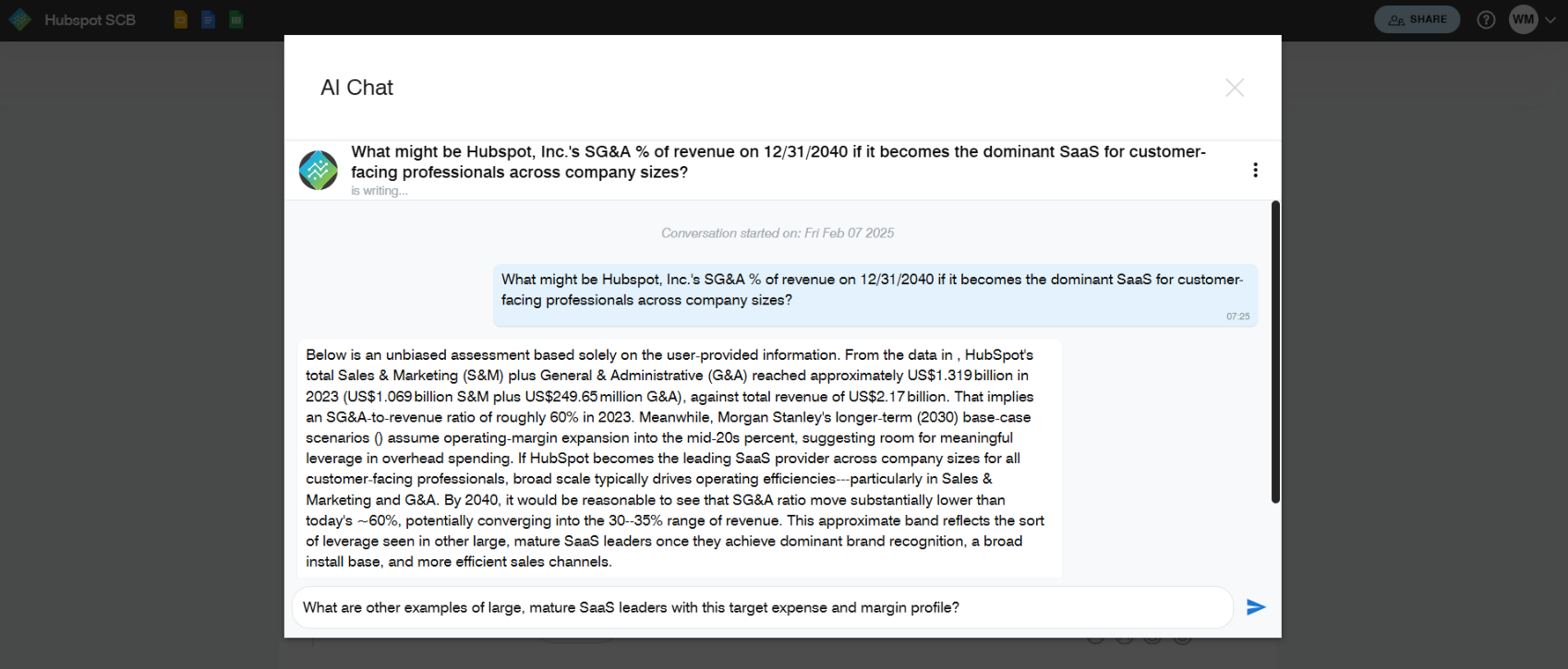

Evidence Mapper

Launch prompts from anywhere–inside spreadsheets, memos, or file folders. Start with BPN’s automatic prompts chat, or write custom prompts to extract, synthesize, and map information. Direct each prompt to look in the company data room, research reports, call transcripts, or spreadsheet calculations. Do this as you write memo sections or stress model assumptions.

Case Builder

Easily upload any spreadsheet or use a BPN template. You can create as many logical cases as you want, with separate tabs for each case. Easily filter variables, time horizons, or cases to zero-in or zoom-out for clarity as you iterate.

SlideDoc Maker

Dynamic visuals based on accurate spreadsheet calculations keep your slides and memos connected to your spreadsheet data and results. You can filter to include or exclude variables, cases, and time periods. This lets you compare assumptions and results side-by-side.

You can set up each slide with several tiles. Create a SlideDoc that tells the story through titles, text sections, and notes in the charts and tables. Embed charts or tables from the SlideDoc into your memo, and they’ll dynamically update with any future changes.

The Vital Function of Human-in-the-Loop Validation

AI isn’t a substitute for human insight and judgment. In fact, a skilled investor can gain 10 times the leverage from AI. They create the memo, manage the sources, and oversee the agents to get the information they need. Bullet Point Network developed our platform with a seamless human-in-the-loop workflow at its core.

This ensures that:

Investors own the assumptions and can add nuance to the conclusions.

Insights are traceable to trusted sources via evidence mapping.

AI chats and manual prompts allow you to go deeper or clarify details.

AI-generated outputs are fully editable.

Memos and slide decks are fully configurable.

Versions can be saved and audited.

Teams can collaborate in real-time, maintaining full transparency.

This structure allows AI to accelerate workflows while final decisions remain under the control of expert human teams.

Collaborative Refinement Cycles

The system includes analyst feedback in AI results. It uses memo design, spreadsheet choices, and supervised feedback. It also has survey-based AI feedback loops, prompt evaluations, output reviews, and ongoing improvements.

Balances AI efficiency with human insight. For example, teams work together to prioritize the most important factors for each analysis. They also use manual source control toggles and adjust weightings for qualitative factors.

Team Collaboration, Personal Versions, and Saved Versions

Centralizes team input by giving everyone access to memos and research posts. It includes clickable evidence links and dynamic charts and tables from spreadsheet calculations.

Each team member can review the master version, see mapped evidence, add new evidence, or debate assumptions. Editors, also known as model builders, can change assumptions in team master versions. They can create personal versions with their assumptions. They can also save versions over time as new information comes in or views change.

This allows teams to map evidence in real-time. It helps them discuss and reach an agreement. It also shows any controversial ideas or conclusions clearly. This process ensures accountability.

AI Investment Solutions Built for a New Future of Investing

At Bullet Point Network, we use AI for purposeful investor decision-making and serious research and analysis. Here’s what our platform solves.

Streamlined Investment Memo Generation

Our Memo Writer tool uses AI to create detailed investment memos quickly. It works much faster than a human analyst. It also offers better depth and quality than a standard LLM. You can use customizable memo templates that resemble your favorites.

There is also automated spreadsheet integration for accurate calculations. This ensures that every memo has the right look, feel, and content to support your decisions.

Automated Evidence Mapping

Achieve a new level of efficiency in investment research with our Evidence Mapper. Our platform systematically gathers and maps research to model assumptions and memo sections. Evidence Mapper ties each assumption to traceable sources to mitigate hallucinations and increase conviction.

By automating the evidence-gathering process, you can focus on the big picture. You’ll have more time to think critically and discuss assumptions and results with your team. This way, you won't be overwhelmed by manual data collection and writing tasks.

Assumption Stress-Testing

Stress test overoptimistic projections, such as unrealistic CAC reductions, by comparing inputs to various financial projections or against historical sector benchmarks.

Maps hidden dependencies. For example, a startup's churn rate can affect its Series B runway. This impact can change based on financial results or fundraising conditions.

Scenario Analysis with Case Builder

Case Builder helps investment teams explore future options. It describes logical cases in words and automatically researches key assumptions. The tool tests these assumptions under stress and compares results with dynamic filtering. This process is much easier and more scalable than managing many spreadsheet tabs.

Evidence-Linked Commentary

Each assumption links to research posts with summaries, excerpts, and footnotes to underlying source documents. This helps you support, debate, or audit the information driving that assumption.

Team members can add evidence and comment on it. Then, they can record the debate directly on the platform.

Easily Create and Compare Multiple Cases

You can simulate different scenarios to test how key factors affect revenue, expenses, cash flow, KPIs, or valuation results. This way, you won't need to keep separate spreadsheet tabs for each scenario.

Assign probabilities to scenarios to evaluate upside and downside risk and consider expected values.

Smarter, Faster Decisions for Investment Teams

By merging AI efficiency with human expertise, Bullet Point Network empowers investment firms to:

Accelerate analysis without cutting corners. Our platform reduces hours of finding, organizing, formatting, editing, and rewriting. Investors can now spend more time thinking, debating, and researching critical drivers.

Standardize insights across the firm. AI investment memos ensure consistency. They help whether an associate is writing the first draft or a partner is reviewing the final cut.

Improve decision-making with coherent narratives, supported by traceable evidence and connected to spreadsheet calculations. Cover blind spots, foster debate, and generate insights that help the team align around key risks and opportunities.

Bullet Point Network transforms uncertainty into conviction, equipping teams to act decisively.

Visualize Key Assumptions and Results With SlideDoc Maker

SlideDoc Maker transforms dense financial models into intuitive, interactive charts and tables. Like Tableau, making and filtering these customizable charts and tables helps SlideDoc presentations connect the numbers to the story. BPN’s AI reads the charts and uses trusted calculations. It helps you draw conclusions in your memo, a significantly better process than just relying on AI.

Dynamic Data Visualization

Connects directly to your spreadsheet model. This ensures accurate calculations and financial logic. It helps create dynamic charts and tables for important financial, business, and valuation metrics.

Visualizations update automatically when assumptions change for any scenario. Memo paragraphs show the latest numbers with just one click. This saves time on manual formatting and reduces errors.

AI-Accelerated Formatting

Uses your model structure to pre-generate slide sections and tailor layouts based on materiality.

Saves investors hours per deck. This is particularly efficient when iterating on model changes, board prep, or limited partner updates.

The Importance of Investment Memos

Investment memos are foundational. They capture insights, structure risks, and guide firm-wide decisions. Done right, they become the source of truth for evaluating a deal.

The Structure of a Strong Memo

Executive Summary

Market and Competitive Analysis

Business Model and Financials

Risks and Mitigations

Team Evaluation

Deal Terms and Recommendations

How AI-Generated Memos Change the Game

In the past, memos were labor-intensive and prone to errors. AI-generated investment memos compile financial models, assumptions, evidence, and deal materials into a cohesive summary. These memos are structured to reflect real-world investor needs, including speed, clarity, and traceability.

Manual vs. AI Memo Comparisons

Manual Memos

Time to Create: 3-8 hours

Consistency: Varies by author

Evidence Integration: Manual copy-paste

Editability: Manual revisions

AI Memos

Time to Create: <30 minutes

Consistency: Standardized output

Evidence Integration: Automated sourcing

Editability: Easily editable

Collaborative AI Investment Memo Generation Capabilities

AI doesn’t replace investors. It’s designed to augment their work and accelerate the decision-making process. Bullet Point Network provides collaborative AI built for investors, helping teams move faster and work smarter. Our platform streamlines the memo generation process while keeping investors in control every step of the way.

Automate Investment Memo Writing

Our Memo Writer AI synthesizes qualitative and quantitative data into structured, high-quality narratives in minutes. Upload source materials, and our engine does the heavy lifting.

Investment Analysis Tools, Evolved

From financial forecasts to qualitative scoring systems, our investment analysis tools bring structure and speed to data interpretation.

Collaborative AI for Venture Capital and Private Equity

Venture capital and private equity teams thrive on collaboration. Our tools allow multiple stakeholders to comment, revise, and co-author investment documents seamlessly, enabling real-time strategy alignment.

The Impact of AI on the Memo Process

In investment analysis, even small misjudgments can lead to large financial missteps. Bullet Point Network addresses this challenge by combining agentic AI with expert human review. Our platform ingests spreadsheet-driven scenarios and critical deal documents, surfaces key assumptions, and drafts memos that align narrative with numbers.

By embedding source-linked evidence directly into memos, we ensure transparency and traceability throughout the diligence processes. Investors remain in control. They edit and validate AI-generated outputs. However, the time-consuming first draft is handled by an AI trained to process like an investment professional. The result? Faster memos, fewer errors, and greater confidence in the final investment thesis.

Streamlined AI Investment Processes

AI cuts through the noise. No more version control nightmares or manually hunting for past insights. Our platform helps you streamline the investment memo process with AI, reducing errors, accelerating output, and improving decision clarity.

Why Investors Trust Our Solutions

Proven Time Savings

Data Traceability

Improved Team Productivity

Optimized Memo Quality

From solo investors to large venture capital and private equity firms, we support smarter, faster investment workflows powered by AI. Bullet Point Network is:

Backed by the National Science Foundation.

Powered by 75,000+ hours of development and two issued patents.

Built for investors who demand clarity, speed, and conviction in every decision.

Best Practices for Implementing AI Investment Tools

Successfully adopting AI investment workflows requires more than just deploying software. It demands thoughtful integration, team enablement, and a clear understanding of how automation fits into the decision-making process. Below are best practices to ensure a smooth, effective implementation.

Training Teams on AI Usage

AI adoption should empower, not overwhelm. Bullet Point Network is designed with a user-friendly interface and guided workflows. With our platform, onboarding is straightforward for investors, associates, and partners.

We support successful implementation with:

Step-by-step tutorials tailored to different user roles.

Live training sessions for teams of all sizes.

Self-serve documentation and video walkthroughs.

Dedicated onboarding specialists for enterprise users.

No coding or technical expertise is required. Your team can start using our AI investment platform within days.

Master Memo Automation With Bullet Point Network

Ready to take control of your investment process? Let AI handle the heavy lifting, so your team can focus on strategy. Connect with Bullet Point Network for your demo today.