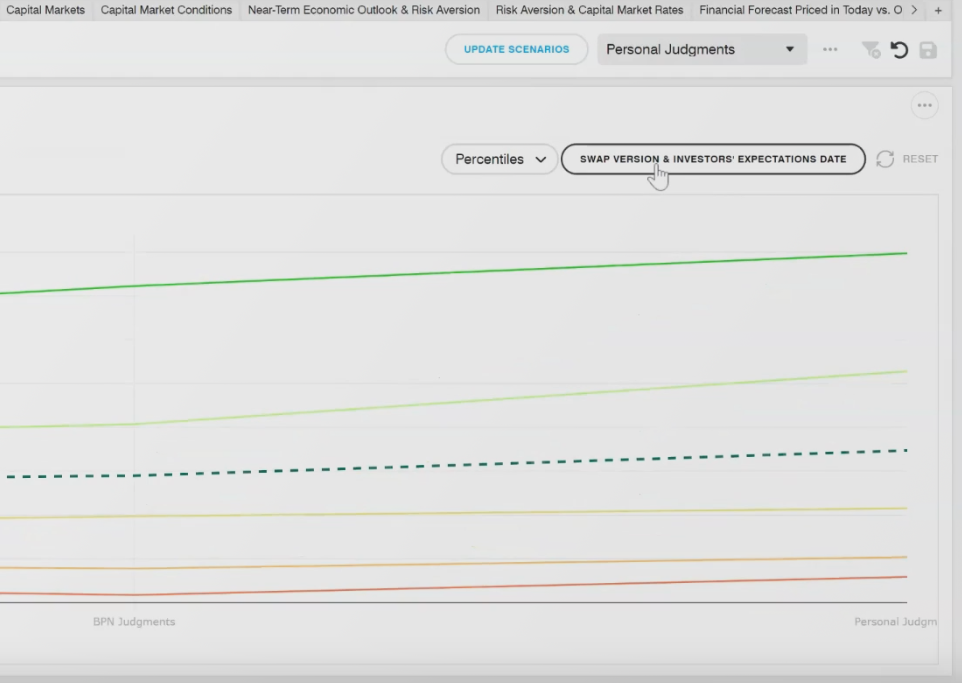

Our poprietary Odds Graph Strategic Scenario Models (“SSMs”) can start with our SSM templates,can be copied from an existing SSM or built from scratch using menus. Leverage our powerful frameworks and capital markets models, flex the key assumptions yourself, and explore the interactive output.

If you want our BPN team to review the data room (under NDA), provide independent research and advisory services, and deliver a complete model and slide deck, we can serve as a formal Challenge Team with conclusions and recommendations summarized in a memo to compare to your own.

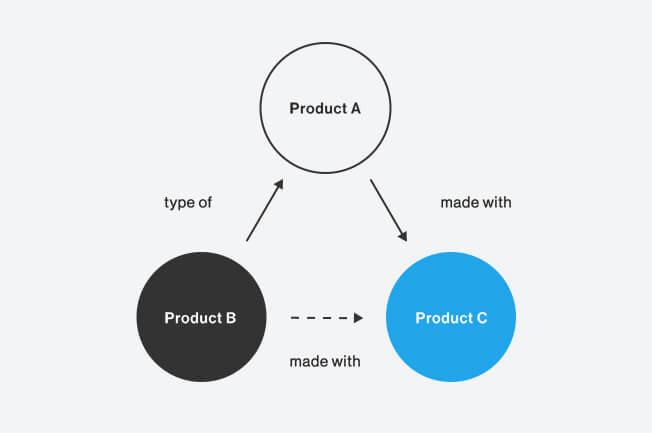

Logical Graphs

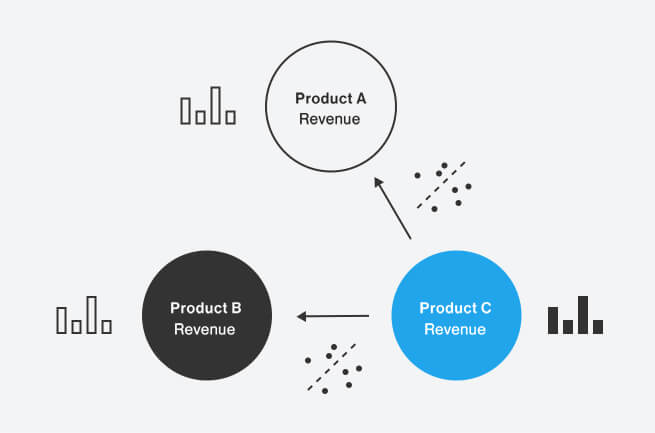

and Probabilistic Graphs

Thanks to 10 years of R&D funded by National Science Foundation grants and private investment, BPN produced a patented architecture that integrates two kinds of graphical models from separate fields of artificial intelligence.

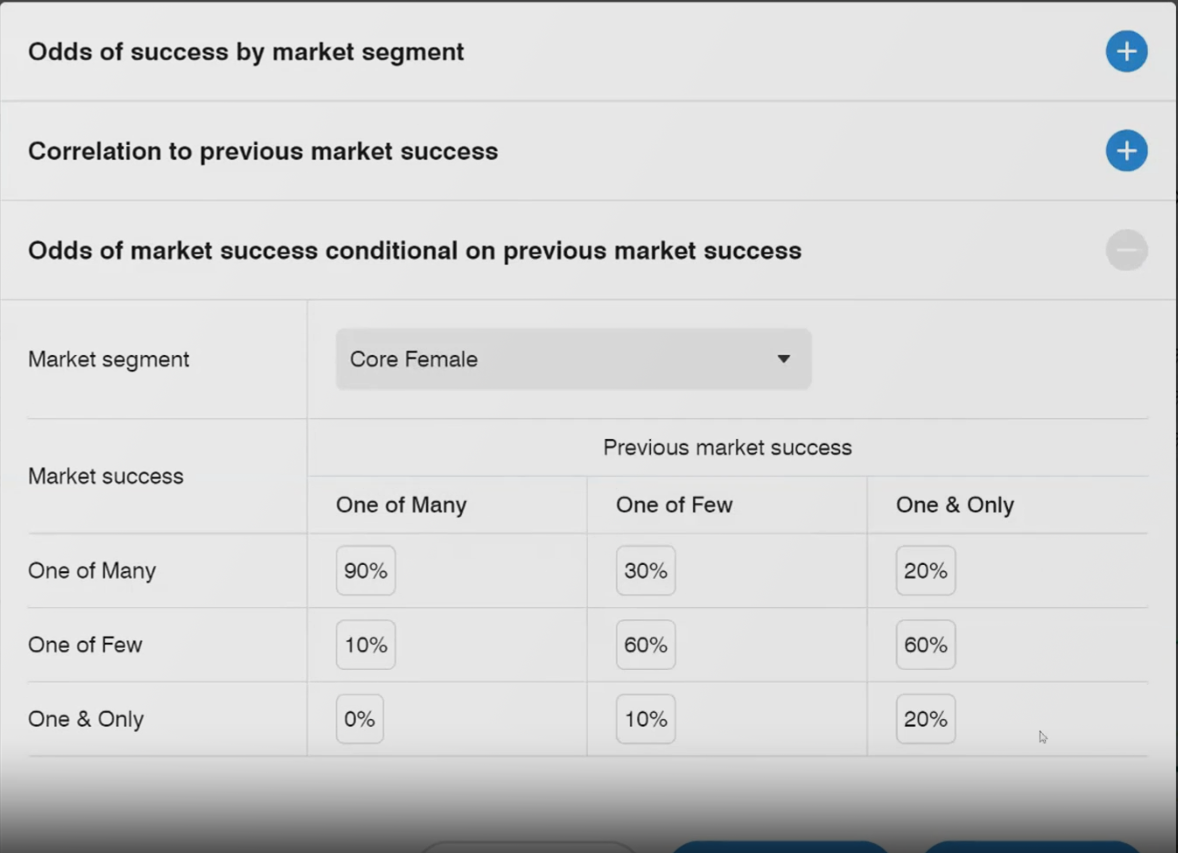

Logical Graphical Models infer some qualitative relationships (the dotted line) from others.

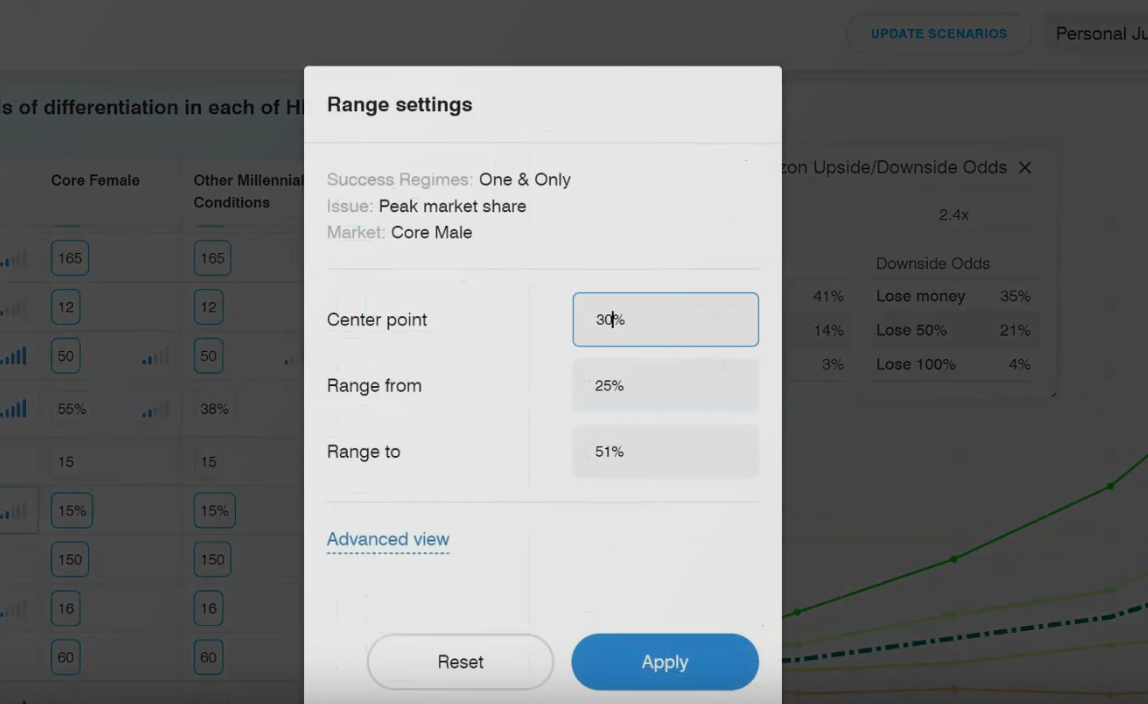

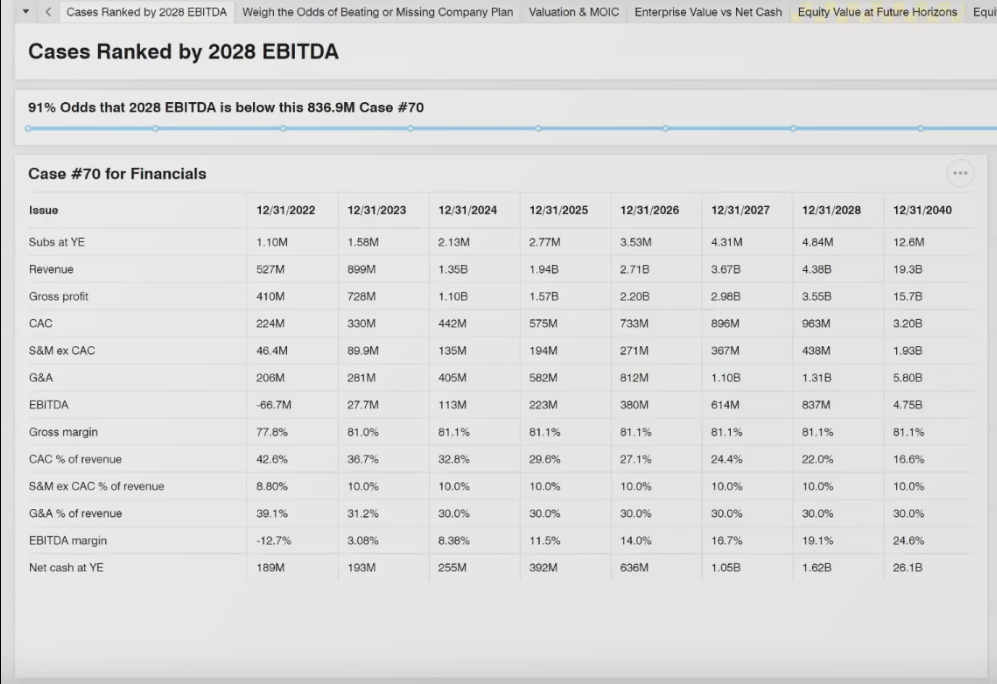

Our patented architecture makes it practical to use a Logical Graphical Model to organize stories about issues more scalably than with folders and tags and to translate them into a Probabilistic Graphical Model that produces many scenarios without writing stories for all of them. With this insight, leaders can make better decisions.

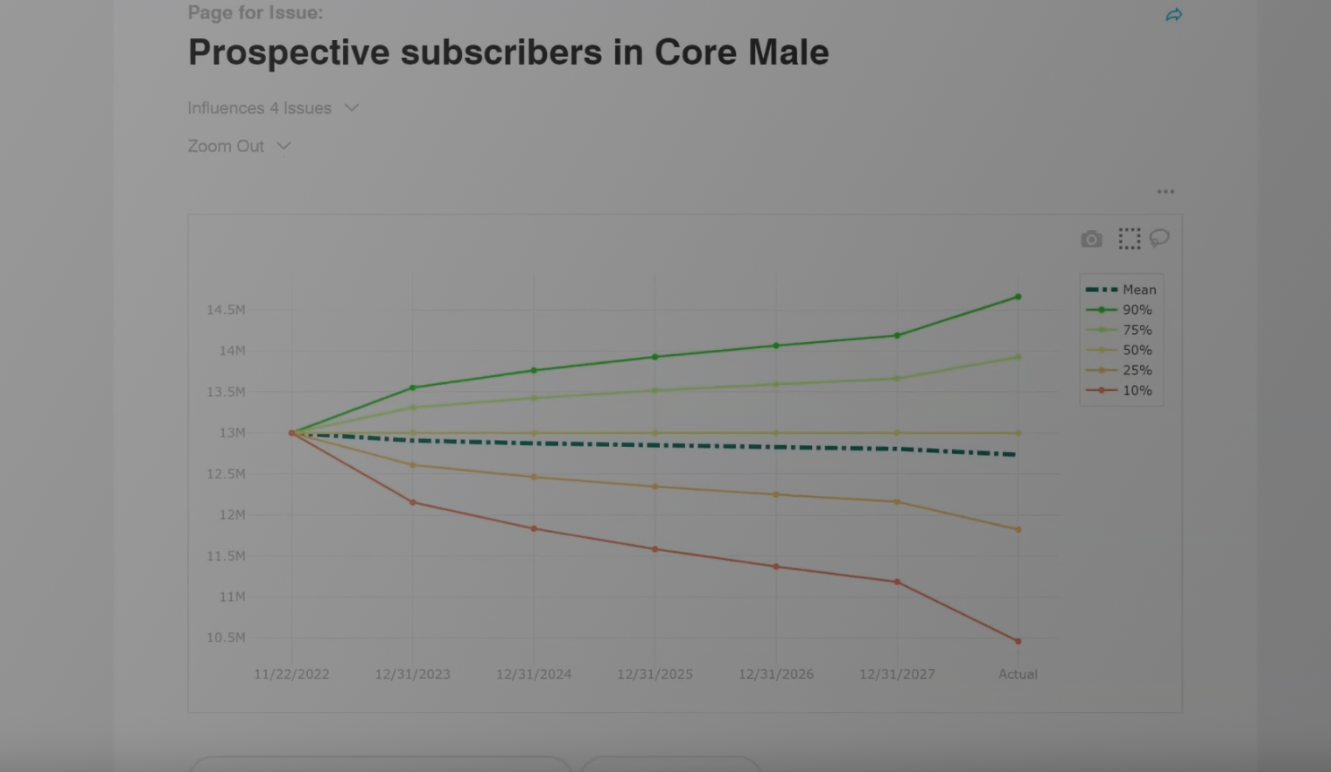

Probabilistic Graphical Models infer odds of scenarios for some Issues (the white bars) from scenarios for some other Issues (the black bars) and the conditionality between them (the scatter plots).

The Bullet Point Network Platform makes it practical for investors and portfolio companies to quantify their stories, driving strategic decisions with data science about not only the past, but also the future.

We’d love to show you the power of BPN’s graph technology and experienced research team.